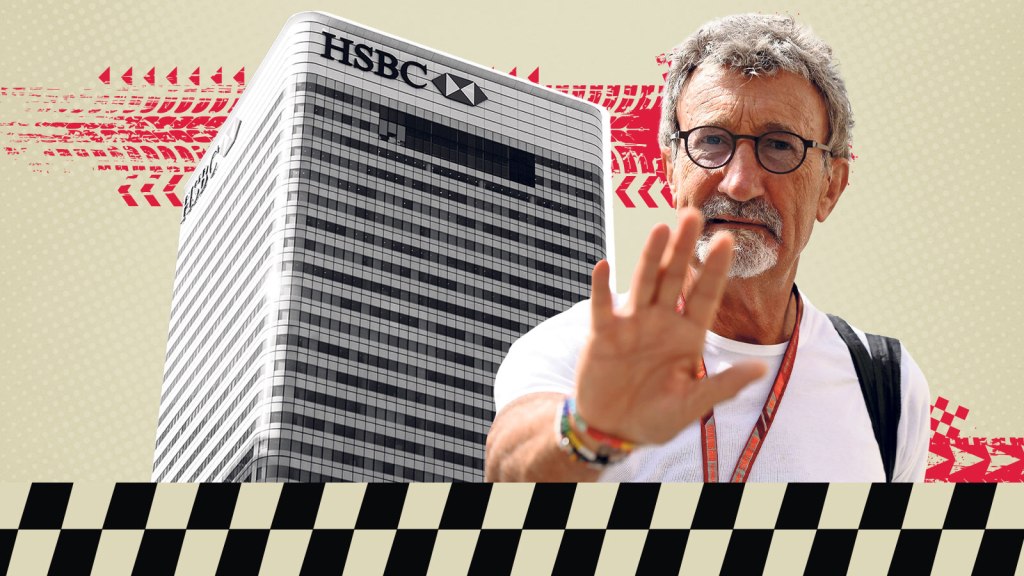

Eddie Jordan Takes Legal Action Against HSBC Over £5 Million Investment Loss

Former Formula 1 team principal Eddie Jordan is suing HSBC, claiming the bank persuaded him to borrow £47 million to invest in a ‘low-risk’ fund, which resulted in a £5 million loss.

Jordan’s investment firm, Pendragon Investment Holdings, alleges that HSBC’s private banking advisers pressured it into investing in the HSBC GIF Global Credit Floating Rate bond fund between 2019 and 2023. The fund was advertised with a mere 1 percent loss risk in a worst-case scenario.

Unbeknownst to Jordan, the fund had exposure to high-risk areas such as the Chinese property market along with investments in Zimbabwe, Russia, and Turkey.

By the end of the investment period last year, the fund had declined by about 10 percent. Simultaneously, HSBC accrued £4.2 million in management fees and interest on the loan taken by Jordan for this investment.

The legal battle, which commenced in the High Court in London last month, underscores the issues surrounding financial advisers who recommend complex products touted as low risk but are actually quite volatile.

Data from the Financial Ombudsman Service analyzed by Oxford Risk shows that complaints about mis-selling and the suitability of financial advice surged from 570 in 2021-22 to 884 in 2022-23. The ombudsman sided with the complainant in 62 percent of the cases last year, an increase from 49 percent the previous year.

Jordan’s case also highlights the risks of accepting investment advice from advisers connected to a single firm. It is advisable to seek help from an independent financial adviser who can offer a wide range of products.

Since 2009, Jordan has been a client of HSBC Private Bank.

In May 2019, HSBC recommended to Pendragon to invest in the HSBC GIF Global Credit Floating Rate bond fund, which involved bonds issued globally. These bonds, generally seen as less risky compared to stocks, are essentially IOUs from companies.

The fund required a minimum investment of £5,000 and was tagged as ‘low-risk’ as per court documents. The four-year investment promised an annual income of about 5.25 percent with 0.33 percent annual charges, returning the original investment upon maturity.

Initially, Pendragon stressed it would only tolerate a 1 percent loss. HSBC reassured that the fund’s primary goal was ‘capital preservation’ and projected potential losses at 0.35 percent under normal circumstances and up to 0.98 percent in ‘stressed scenarios’ like the 2008 financial crisis, with losses beyond 1 percent deemed unlikely.

• HSBC was no help when I lost £120k in a Christmas scam

Pendragon had access to a Lombard loans facility via HSBC’s private bank, which allows wealthy clients to borrow against their liquid assets.

HSBC advised Pendragon to secure £66.7 million to make the investment, warning about potential oversubscription risks. Pendragon eventually invested £46.9 million, earning HSBC £1.3 million in fees and £2.9 million in loan interest over the four years.

However, it was later revealed that the investment wasn’t oversubscribed. An October 2023 company factsheet indicated the fund held $261.7 million (£206.2 million), with Jordan’s investment comprising nearly a quarter of its assets.

Pendragon claims HSBC’s communications, which failed to disclose the fund’s exposure to volatile markets like Russia, Turkey, and Zimbabwe, contained ‘false’ statements made either negligently or without reasonable grounds.

As the fund’s value declined, Pendragon repeatedly inquired about its performance, especially during the 2020 COVID outbreak.

HSBC provided reassurances, attributing losses to a ‘mathematical’ error that would be corrected, urging Pendragon to maintain the investment to maturity and warning of a 0.35 percent penalty for early exit.

From June 2019 to June 2023, the fund dropped 10 percent. By contrast, Blackrock’s Emerging Bond ETF, a ‘higher risk’ emerging market fund, declined only 2 percent over the same period, according to Pendragon’s court submission.

Pendragon contends that HSBC should have advised closing the investment in September 2019, amid significant capital loss or in February 2020 when COVID risks became apparent. At those points, losses would have approximated 1 percent.

Jordan now seeks £4.94 million from HSBC, representing the difference between the bond’s maturity value and his initial investment, excluding the income earned but offset by loan interest and charges.

• HSBC error left me with no money to pay for Mum’s funeral

HSBC declined to comment and has 14 days to respond to the court claims. Requests for comment were also directed to Pendragon’s lawyers and Jordan.

Paul Angell from the investment platform AJ Bell remarked, ‘While most investors won’t be solicited into such funds, it’s crucial never to feel pressured into investments, particularly those you don’t fully understand.’

‘Reputable investment firms’ recommended buy lists can help investors narrow choices, considering management team quality, past performance, price, and fund size,’ Angell added.

• HSBC chairman Mark Tucker knighted in King’s birthday honours

A good financial adviser won’t rush you into investment decisions. Always inquire about product details, charges, and risks, and agree on an adviser’s fee upfront.

Your adviser should provide a suitability letter outlining the advice received and reasons for recommendations. If you disagree or are unclear, ask further questions before proceeding.

If using a discretionary fund management service, ensure satisfaction with the risk level agreed upon at the start of your advisory relationship, typically determined through questionnaires and interviews.

Post Comment