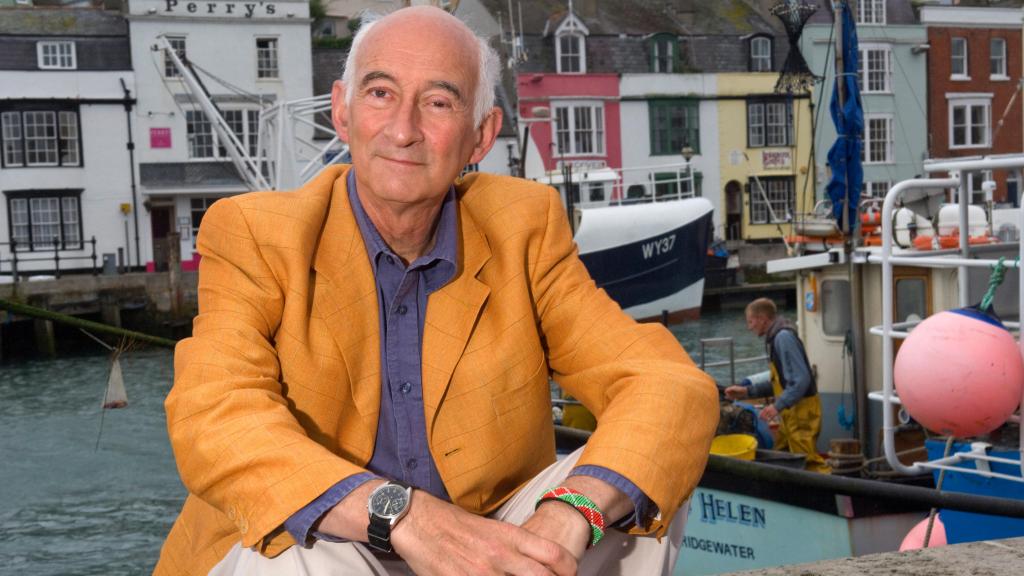

Insights from Paul Atterbury: Why Wealthy People Value Money

Paul Atterbury, an expert in 19th and 20th-century art, architecture, design, and history, holds a particular fascination for railway history, the First World War, sculpture, and jazz from the 1920s and 1930s. He has served on the ‘miscellaneous’ team of the Antiques Roadshow for 34 years, lectured globally, curated exhibitions including several at the V&A in London, and helped establish the Dorchester Literary Festival. Atterbury, now 79, participates in fairs and art markets, holding a stand at the Sherborne Antiques Market in Dorset. Interestingly, his BBC puppeteer mother, Audrey Atterbury, inspired the character Andy Pandy in the 1950s BBC children’s puppet show. He resides in Weymouth with his wife, Chrissie.

Atterbury mentions his preference for carrying cash, stating, “I like cash and do carry some, but for buying a bus or Tube ticket or at the supermarket I use a debit card. If I’m going round antiques fairs, cash is king, and I’d take £200 in case I see something I really like. I buy mostly and sell a bit, but only as a hobby.”

He avoids credit cards due to his aversion to debt, citing his grandparents’ influence. “I gave them up ages ago because I’m not interested in debt. My grandparents helped me believe that if you want something, you have to be able to pay for it in cash,” he explains.

Recounting his early work experience at 16, Atterbury worked for a puppeteer in a traveling company that set up the Little Angel Puppet Theatre in Islington, which was in a derelict war-bombed church. His fascination with carving wood and making puppets began here.

Atterbury recalls a memorable moment on the Antiques Roadshow in Scotland when a man brought in a peculiar item covered in a black tarry substance, claiming it was a dead dog. The item turned out to be a rare survival, confirmed by a local museum representative.

Another significant moment occurred in Australia when a man presented a wooden box containing a piece of wood reportedly from the keel of Captain Cook’s ship, the Endeavour, valued at around $250,000.

Atterbury’s financial habits include using a Post Office savings book since childhood and enjoying Premium Bonds, which he finds more rewarding than bank interest.

Describing his parents’ financial status, Atterbury shares, “We’re probably about the same. At my age, they owned their houses and were comfortable.”

Discussing wealth, he reflects, “I’ve never felt wealthy. I’ve felt very comfortable such as when I was writing my railway books which were very successful. But when that phase ended, we went back to where we were before.”

The worst financial period for Atterbury was in the early 1970s, struggling with high-interest rates while buying his first flat.

With a prolific career writing about 40 books, he describes the income from writing, lecturing, and television as his pension fund, although he once faced a significant financial setback when a publishing deal fell through.

Atterbury enjoys a mixture of income sources, including cruise ship lectures, which paid well and provided an all-expenses-paid experience.

He proudly owns his house in Weymouth outright and also has a rental property nearby.

Atterbury does not consider himself a capitalist but holds onto some shares handed out by banks and insurance companies long ago.

One of his best investments was in a house, though he doesn’t buy property to make money, but to live in it. A garden design course and subsequent renovations cost £25,000 but resulted in a wonderful garden.

After exiting corporate life in 1981, Atterbury vowed never to work for anyone again after being fired from his last job, a vow he has kept.

If given a windfall, he would pay off the mortgages of family and friends and support museums, galleries, and libraries. Antarctica and a camper van trip around Australia are also on his dream list.

Recent earnings have been declining, with 2021/22 turnover at £27,567 and a profit before tax of £20,772.

Given a hypothetical choice, he would prioritize property investment as a primary necessity, emphasizing the importance of living debt-free.

Atterbury shares a valuable lesson from childhood about the frugality of the wealthy, recounting a cruise where his father’s wealthy friend showed him the value of saving money even in small ways.

Rich people often have money because “they are very mean and very good at money,” Atterbury adds, underscoring a critical difference in financial attitudes.

Post Comment