Is Your British Gas Boiler Cover Rising by £112? Here’s What You Can Do

Q. I have been a long-time British Gas boiler cover customer, but my premium is increasing from £234.12 to £346.18 this year, despite not making any claims. This feels like extortion, particularly as I was not given the option to increase my callout excess above £60 to lower my premium. The call center provided no explanation—can you help me understand why the cost has risen so sharply when inflation is about 2 percent? Tom, Sevenoaks

In recent years, home emergency and boiler cover have drawn much attention. Common complaints include delays in emergency callouts, repair issues, and exclusions in contracts. Lately, significant and unrealistic premium hikes have become more frequent.

Upon receiving their insurance renewals, many customers are likely shocked by price increases sometimes reaching 50 percent for motor, home, and contents insurance policies.

• How to save money on your energy bill

There are various reasons for increasing insurance premiums. If you made a claim last year, that’s one reason. For home emergency and boiler policies, the rising costs of repairs and raw materials is a common culprit. The age of your boiler or heating system also matters—British Gas noted that when a boiler exceeds 6 and 11 years, the cover price can rise.

Your boiler model can impact the premium, especially if spare parts are no longer available, and the number of radiators in your property (the average is seven) can also play a role. External factors like engineer availability in your area and the annual number and cost of claims nationally can also drive up costs.

Insurers are not required to disclose detailed reasons for substantial premium increases, which frustrates customers. Detailed breakdown requests are often denied, making it difficult to understand how to lower your bill.

The market for home emergency, central heating, and boiler insurance lacks many specialist competitors, leading many to stick with their current provider. However, other options are available if you face an unreasonable premium increase.

Although you weren’t able to increase the excess, other readers might lower their premiums by doing so, decreasing the coverage level, or selecting a more basic policy.

• British Gas left my 94-year-old neighbour in tears

Opting for a basic boiler or heating service or replacing an old boiler can reduce your risk as a customer, potentially lowering your premiums. Ask to remove any unnecessary policy benefits to cut costs further.

The best way to reduce your bills is to negotiate with your insurer and be willing to switch providers if they won’t lower the price. In your case, this strategy paid off—you bargained over the phone, and British Gas agreed to reduce your premium by £98, making the annual increase just £14. It always pays to ask.

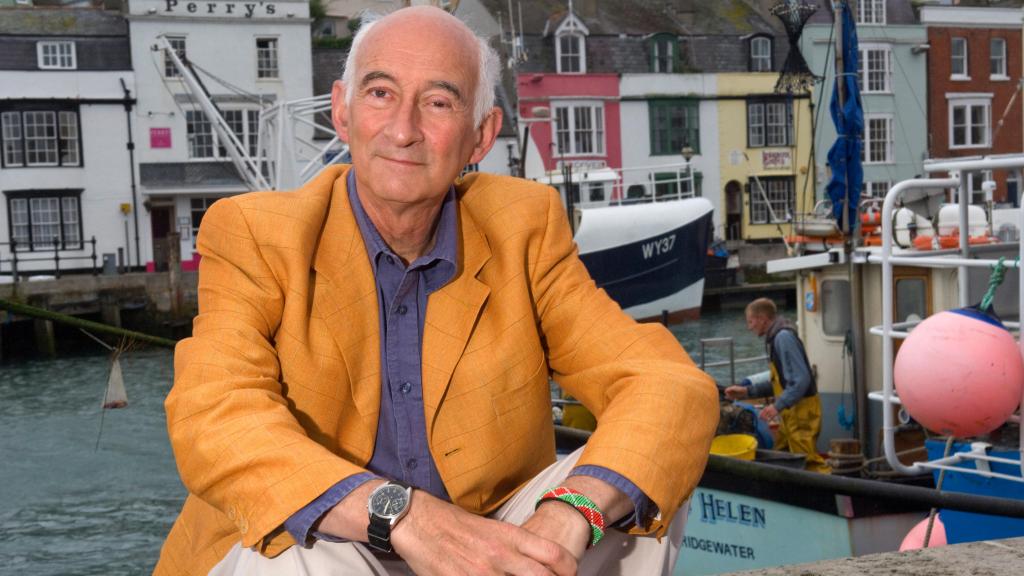

Martyn James is a consumer rights champion covering various issues from energy bills to canceled flights and pothole claims.

Post Comment